CEO hails business model ‘resilience’ thanks to stable greeting card market

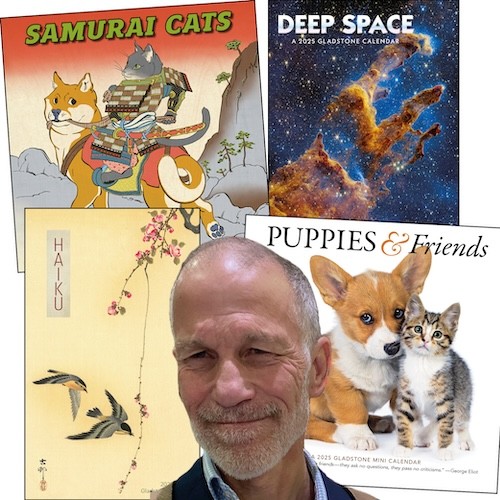

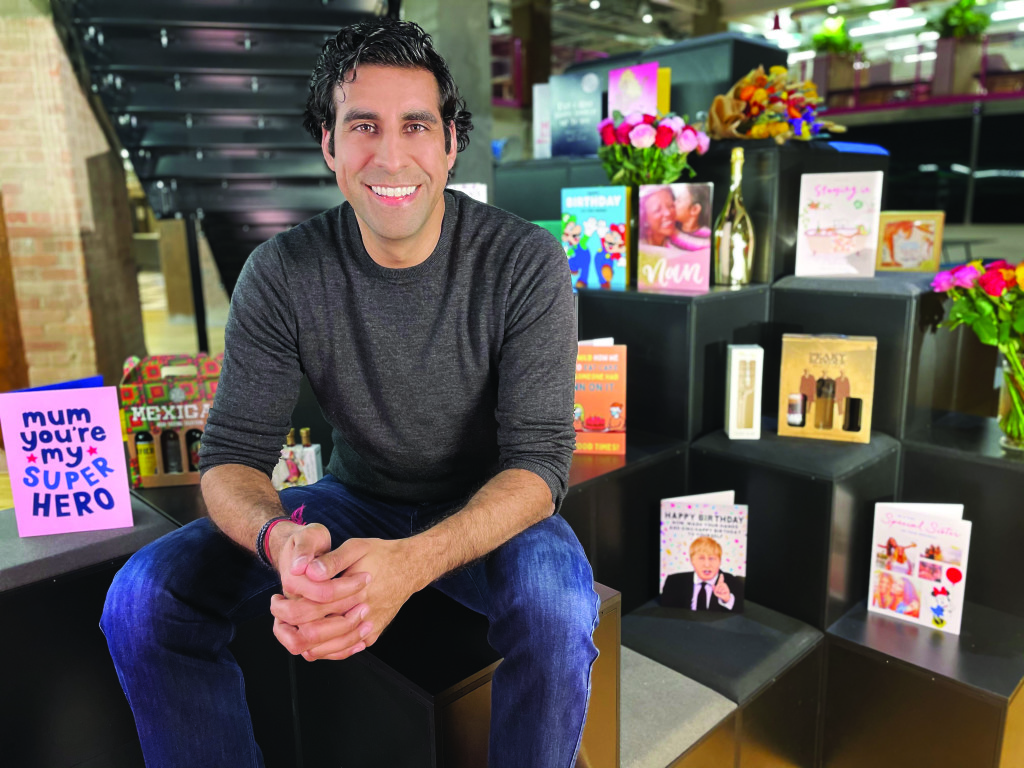

Moonpig has reported a jump in annual sales as ceo Nickyl Raithatha hailed the “resilience” of its business model thanks to the “stability of the greeting card market”.

Despite the economic downturn affecting the business since last October, Moonpig’s results for the year ended 30 April showed year-on-year revenue growth of 5.2%, from £304.3million to £320.1m, and gross profit rose 19.7% to £179.7m from £150.1m.

Nickyl said: “The results demonstrate the resilience of our business model which is rooted in the stability of the greeting cards market and our unique use of data to drive customer loyalty. We have high profitability, strong cash generation and inherent flexibility that allows us to respond rapidly to a dynamic macroeconomic environment.”

The report, released on Thursday, 29 June, said it had been “a milestone year establishing key capabilities to drive future growth”, with the technology team expanded to 250 from 195 roles to focus on delivering new features for customers, and new operational facilities opened in Tamworth as well as Almere in the Netherlands.

It also trumpeted continuing customer acquisition across both Moonpig and sister brand Greetz, the Dutch online greetings service, with joint revenue from new customers hitting £31.7m, remaining ahead of pre-pandemic levels which were at £23.9m in the full year to April 2019.

Adjusted EBITDA grown was £84.2m, against £74.9m the year prior, however adjusted profit before taxation was down at £48m compared to £51.5m in 2022 after Moonpig was impacted by higher interest rates and the investment in technology, and reported pre-tax profit slipped 12.6% to £34.9m, the second year running it has fallen.

Although sales were higher, the ceo said it reflected a rise in the pricing of its cards, along with fewer promotional discounts, as the average order value rose from £7.70 to £8.30, and he admitted fewer cards had been sold than the previous year but “on a per customer basis our customers are buying more cards per year than they were before Covid”.

The report explained the group has now formed a single global design team for greeting cards to “leverage the strength and breadth of our UK range across geographies” and it manages both in-house and licensed designs, currently focusing on bringing global licensed properties that already feature on Moonpig, such as Marvel, Disney and Star Wars, to Greetz.

Nickyl added: “We are innovating to differentiate and elevate Moonpig cards with embedded video messages, personalised content and the ability to include a gift experience within the card. We have continued to extend our market leadership in online cards and we expect to return to growth during the year ahead, underpinned by our continued investments in our technology, marketing and operational capabilities.”

Trading since the start of the year has been in line with the group’s expectations and it expects revenue to grow at a low single-digit percentage rate in the first half of the 2023-2024 financial year “underpinned by the Moonpig brand, which has been in growth since March”, with all brands returning to growth in the second half.

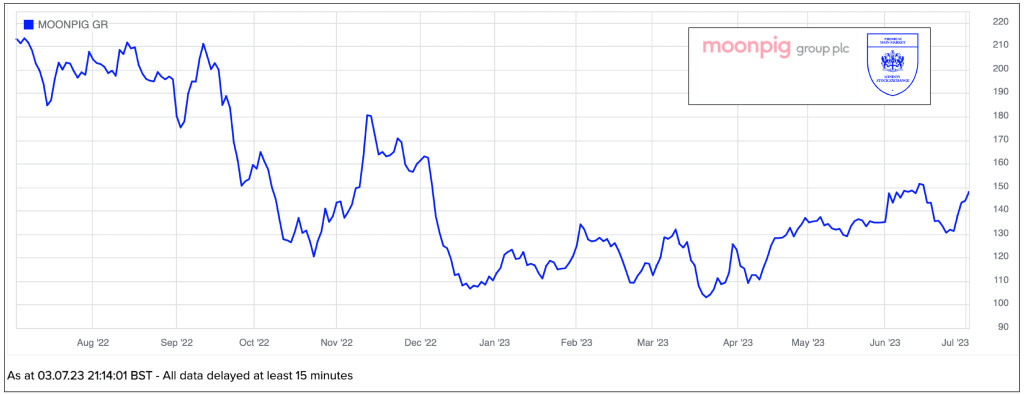

Having been floated on the London Stock Exchange in 2021, Moonpig shares are down 36% over the past year, but were up 4% on Friday at 143.5p and closed up again 2.63% at 148p yesterday, July 3, and Nickyl concluded: “As the clear online leader in greeting cards, Moonpig group is well positioned to benefit from the long-term structural market shift to online.”