Pre-tax figures hit £65.5m as retail giant ceo toasts ‘much stronger business’

Strong store performance has boosted Cardfactory to record a surge in both sales and profits with the pre-tax figures rocketing 25% to £65.6million as well as moving to become a “stronger business” both financially and operationally.

Preliminary figures released today, 30 April, for the full year to 31 January, 2024, show group revenue at the greeting card retail giant jumped 10.3% to £510.9m, with store sales growing 7.7% on a like-for-like basis, driven by a “strong store performance”, with growth in card, gifts and celebration essentials, combined with positive traction in online lfl sales edging up 0.4%.

In today’s statement, Cardfactory said the sales results reflected “continued positive momentum across the business and effective execution of our strategy”, and “development of our store layout, customer experience and ranges, as well as annualisation of targeted price increases”.

The profit before tax is £65.6m compared to £52.4m in FY23, while earnings before interest, tax, depreciation and amortisation (ebitda) were £122.6m, a £10.6m increase on the previous year, and net debt excluding leases is down to £34.4m from £57.2m.

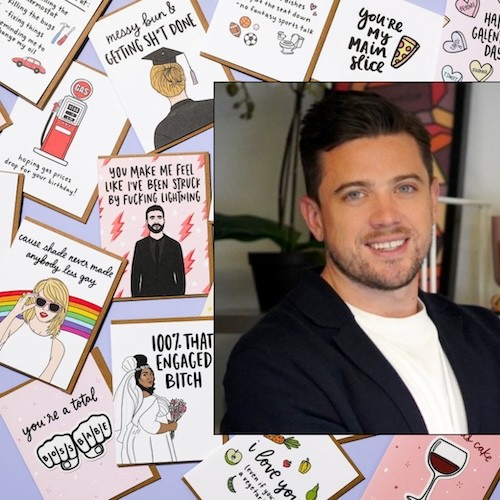

Chief executive Darcy Willson-Rymer said: “I am delighted with the progress we have made through the year which would not have been achieved without the commitment and efforts of our colleagues.

“Now, three years into our Opening Our New Future Strategy, Cardfactory is financially and operationally a much stronger business.”

“This means we are able to both reinstate the dividend and invest in the future, while effectively navigating the ongoing economic environment. We have confidence in our strong value and quality customer proposition, and remain on track for both this financial year and for achieving our FY27 targets outlined at our Capital Markets Day in May last year.”

On the greeting card front, the company said innovation and range development to broaden customer appeal and price points contributed to 4.8% lfl growth, and the business continues to tailor offering for different regions and demographics to further grow its “card market authority”.

And the statement added: “Successful implementation of card pricing architecture maintained our long-standing value-for-money credentials and low entry price points by ensuring the right balance of targeted price increases and rotating promotional offers.”

Cardfactory is continuing to focus on growing its share of the £12billion gifts and celebrations essentials market, having expanded ranges over the year including own-label ranges, a new stationery range and the introduction of key licensed ranges. There was particularly strong lfl growth in soft toys, up 42%, stationery increased by 63% and pocket money toys rose 44%.

And the positive impact of the store evolution programme enabled the optimisation of space and balance between card, gifts and celebration essentials and contributed to strong 9.8% overall lfl growth in gifts and celebration essentials.

Total store revenue grew 8.7% including from the 26 new store openings in the period, while the partnership revenue totalled £17m, which includes the SA Greetings arm acquired in April 2023 which contributed £10.4m of that, in line with expectations. The business now has 1,046 stores in the UK, having ended 2022 with 1,020.

Moving forward, a record trading day on the Saturday before Mother’s Day this year, 10 March, has ensured trading since the start of the new financial year has been in line with the board’s expectations, with continued positive momentum across card, gifts and celebration essentials for the FY25 spring seasons of Valentine’s Day and Mother’s Day.

FY25 will see further expansion including baby gifting and stationery, alongside further space optimisation for growth ranges such as pet gifting.

Cardfactory chairman Paul Moody added: The strong revenue growth we saw in the year demonstrates the strength of our customer proposition and the benefits of the Opening Our New Future strategy. There is continued good momentum within the business with our offer is resonating well with our customers.

“Our value offer remains crucial to our success, particularly during the ongoing cost-of-living challenge that dominated consumer spending decisions through 2023. Range development and innovation to broaden customer appeal ensured we remained relevant for customers to support growth.”