Card Factory this afternoon (July 28) unveiled its ambitious five-year strategy, with a stated intention of becoming the “world’s best greeting card retailer.”

At a virtual Capital Markets Day briefing, the Card Factory senior management team presented the key elements of the retail group’s growth plans and cost efficiencies.

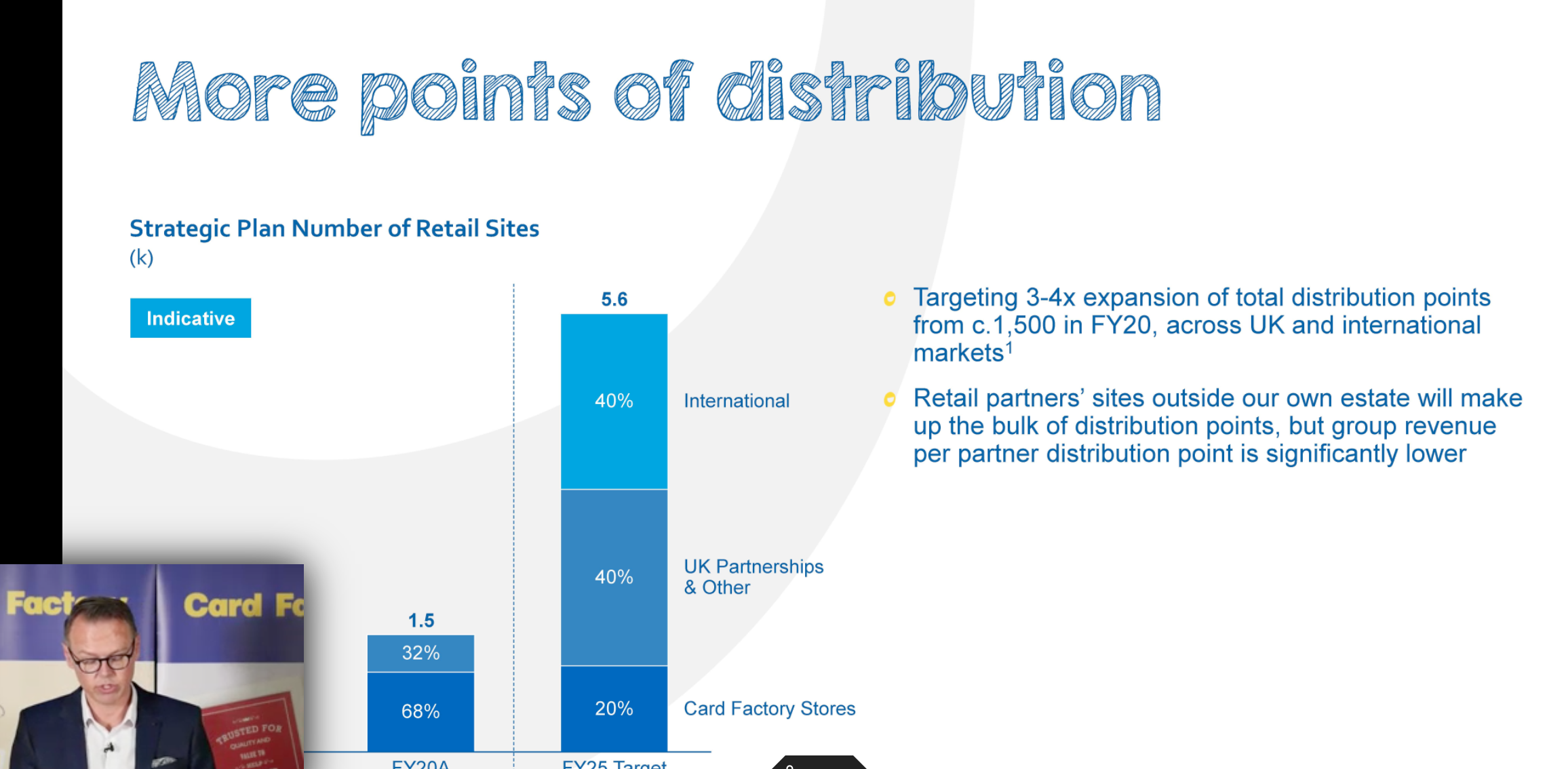

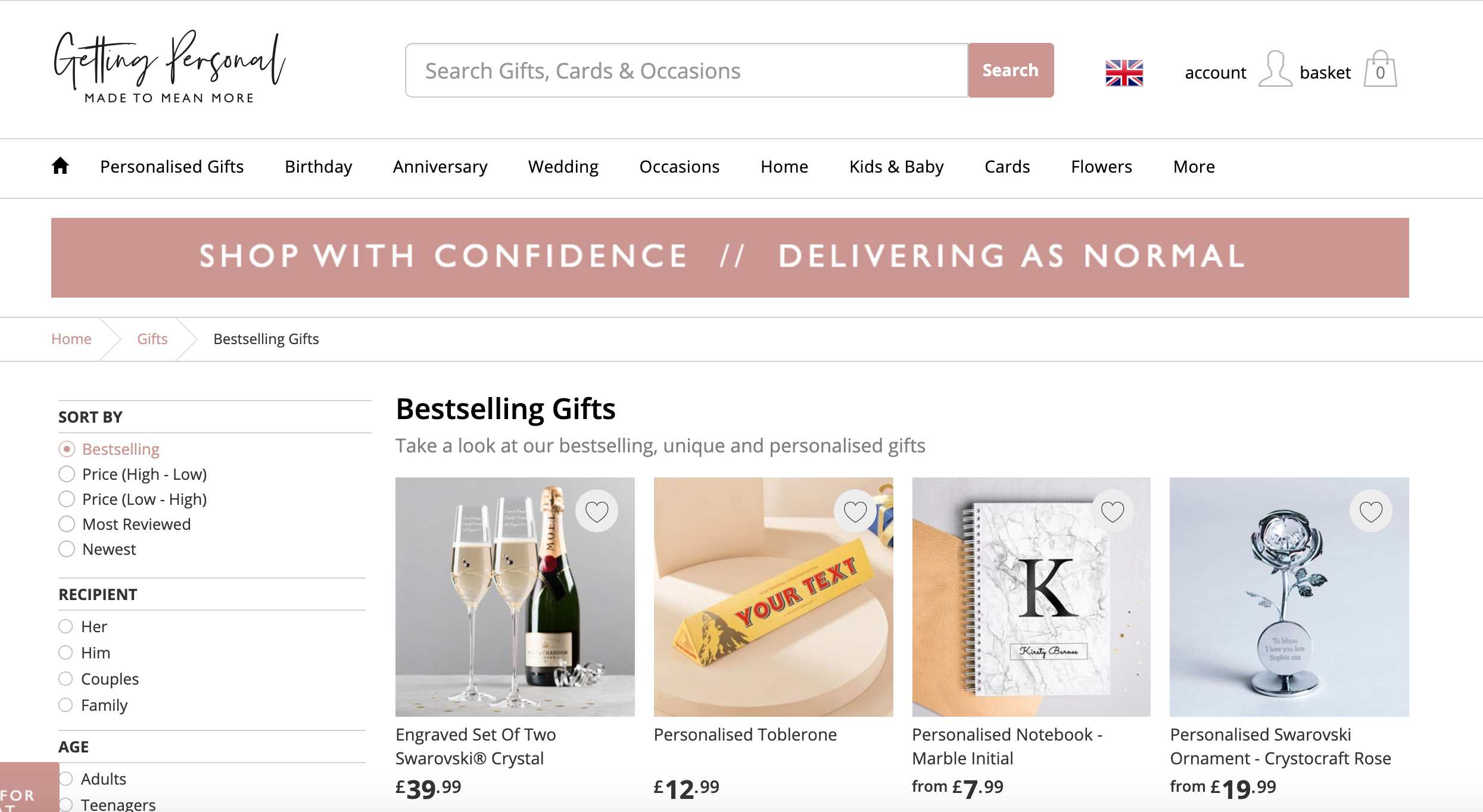

As part of a mission, which the team believe will see Card Factory increase its UK market share of the everyday card market to 45% (by volume) by 2024 (up 11% on its current position) and 31% by value (up from the current 20%), the retailer will look to open a few more stores, but largely the growth will come from building its online presence as well as forging retail partnerships with other brands, such as it currently enjoys with Aldi.

However, Card Factory’s ambitions on the retail partnership front go way beyond UK shores. Citing its arrangement with The Reject Shop in Australia as a prime “case study” which Card Factory supplies with a branded selection of cards, the Wakefield based business is to foster relationships with other retail players all over the world. As part of this it has set its sights on securing a 10% share of the everyday card market in the States, a market very much dominated by Hallmark and American Greetings.

Having previously stated that the ceiling for company-owned stores was 1,200, the retail group’s new five-year plan is to operate from around 1,100 of its own stores, but secure an additional 4,500 ‘distribution points’ (UK and international) through various retail partnerships. The retailer is currently trading from 1,015 stores of its 1,018 stores in accordance with Covid secure guidelines.

While the full extent of Covid-19 is still to play out, Paul Moody boldly stated that, Card Factory’s like-for-like sales will increase 3% by 2023.

In pursuit of improving efficiencies and reducing lead times, investment has been made in the retailer’s UK print business, Printcraft, which will result in 75% of all Card Factory’s cards for its stores being produced in the UK, bringing a big slug of manufacturing back to the UK.

This important presentation comes at a time when Card Factory shareholders are seeking reassurance after a plummet in the share price and the departure of ceo Karen Hubbard (https://www.pgbuzz.net/karen-hubbard-ceo-of-card-factory-is-leaving-the-business/).

Top: Card Factory’s growth will not come through its own stores, but retail partnerships