Dividends of just 2.52% payable from now-collapsed retailer’s 2021 administration deal

Paperchase’s unsecured creditors such as greeting card publishers have been stuck with a £20million bill from the retailer’s first fall into administration.

As the business has just collapsed for the second time with the loss of all jobs and closure of more than 100 High Street stores, The Times revealed on Saturday, 11 February, that the stationery and greetings company’s creditors have been notified they will receive dividends of just 2.52% from the sale of assets which has been progressing since 2021.

The latest pre-pack administration deal, concluded on 31 January, ended speculation about the stationery and greetings business sparked when it was put up for sale on 11 January, just four months after current owner Steve Curtis took over with Aspen Phoenix Newco running the operation.

Tesco, the UK’s largest retailer, stepped in to take the IP and brand within its offer and boost its non-food proposition – but not including any of the stores or around 1,000 staff.

All Paperchase standalone shops and concessions are currently in the midst of closing down sales, along with the online store, and gift cards are only being honoured until 5pm today, 14 February.

“Paperchase is a well-loved brand by so many, and we’re proud to bring it to Tesco stores across the UK,” commented Jan Marchant, managing director of Home and Clothing at Tesco. “We have been building our plans to bring more brands and inspiration to the ranges we currently offer, and this will help us to take those plans further.”

Having undergone a company voluntary arrangement (CVA) in 2019 to pay creditors over a fixed period, Paperchase hit trouble again during the pandemic when stores were forced to close for most of spring 2020, then again in the November when it lost £1.1m over the Christmas trading period where it had profited by £6.2m the year previous.

That led to the initial controversial pre-pack deal in January 2021 which left many small publishers saddled with debts known to be as much as £45,000 and understandably aggrieved that new owners Aspen Phoenix Newco – affiliated to previous owners Primera Credit – carried on selling through their unpaid-for stock.

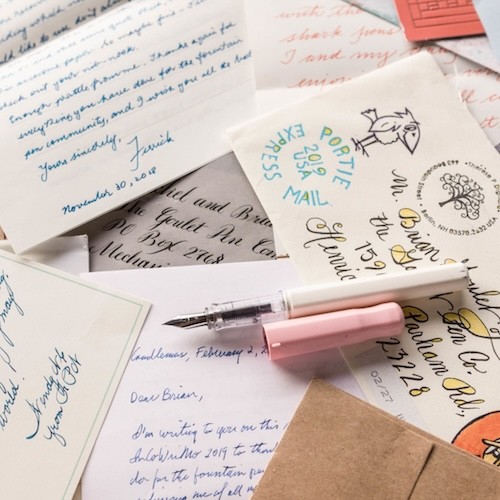

Comedian and TV presenter Joe Lycett has been a champion of the greetings industry by calling out Paperchase’s treatment of publishers, artists and designers, on his social media accounts, culminating with Channel 4’s Joe Lycett: Got Your Back special episode before Christmas.

It featured a 20-minute section devoted to covering the 2021 administration deal, including interviews with three artists collectively owed more than £60,000 – Bow & Bell’s Kelly; Angela Chick, who designs and sells cards under her own name; and Liz Faulkner, co-owner of Jelly Armchair, who said the £22,000 outstanding had been “devastating – we’ve been fighting off bankruptcy for a couple of years”.

Joe displayed his own Christmas cards that he designed and sold in October, raising £17,000, and then handed envelopes to artists Angela, Liz and Kelly containing cheques dividing the proceeds between them.

Other publishers have been pushing the issue around what happened with the 2021 deal. Hole In My Pocket’s Allistair Burt told PG Buzz there is an investigation under way because there are rules in these situations, and some creditors have engaged companies to ensure all those rules were met.