In what should be seen as a show of faith for greeting cards per say, Moonpig has got off to a flying start with its stock market flotation.

Moonpig, the market leader in online print on demand greeting cards, experienced an astonishingly positive reaction to its flotation this week. The shares were placed at £3.50, but by the end of the first day trading the share price had soared by 17%, valuing the group at £1.4billion – even exceeding the £1.2billion that many thought was overly ambitious.

Moonpig is the first major technology company to float this year, and the Financial Times pointed to investor enthusiasm for so-called ‘Covid winners’.

The floatation raised some £20m to fund expansion while existing shareholders, including private equity firm Exponent, cashed in some shares netting more than £400m.

Company executives, including chief executive Nickyl Raithatha, chairman Kate Swann, (a big greeting card fan who was formerly chief executive of WHSmith) and finance director Andy MacKinnon all sold shares worth more than £10 million.

Commenting on the timing of the flotation, Moonpig ceo Nickyl said that as the market shifted online, “now is the perfect time for us to bring the company to the public market, and we are excited about Moonpig’s prospects for the future”.

With investors celebrating the spectacular stock market debut, AJ Bells’ investment director Russell Mould quipped to Daily Mail journalist Matt Oliver: “Apparently pigs do fly, well Moonpig did at least.”

Meanwhile, Neil Wilson at Markets.com was quoted in The Guardian as saying: “Moonpig’s market share is huge (60% of online cards in the UK in 2019) and the trend towards online that will last beyond the pandemic is supportive of future growth. Huge market share, strong growth prospects and good margins – what is not to like? Maybe the valuation, but as we have seen before that is hardly a barrier to online retail stocks.”

Exponent, the private equity company which acquired Moonpig in 2016 sold £56 million worth of shares, but has retained a 26.6% market share, which was valued at £372 million as of yesterday (February 3).

In the six months to 31 October 2020 Moonpig reported a huge increase in sales, up 135% on the prior year, taking it to £155.9m.

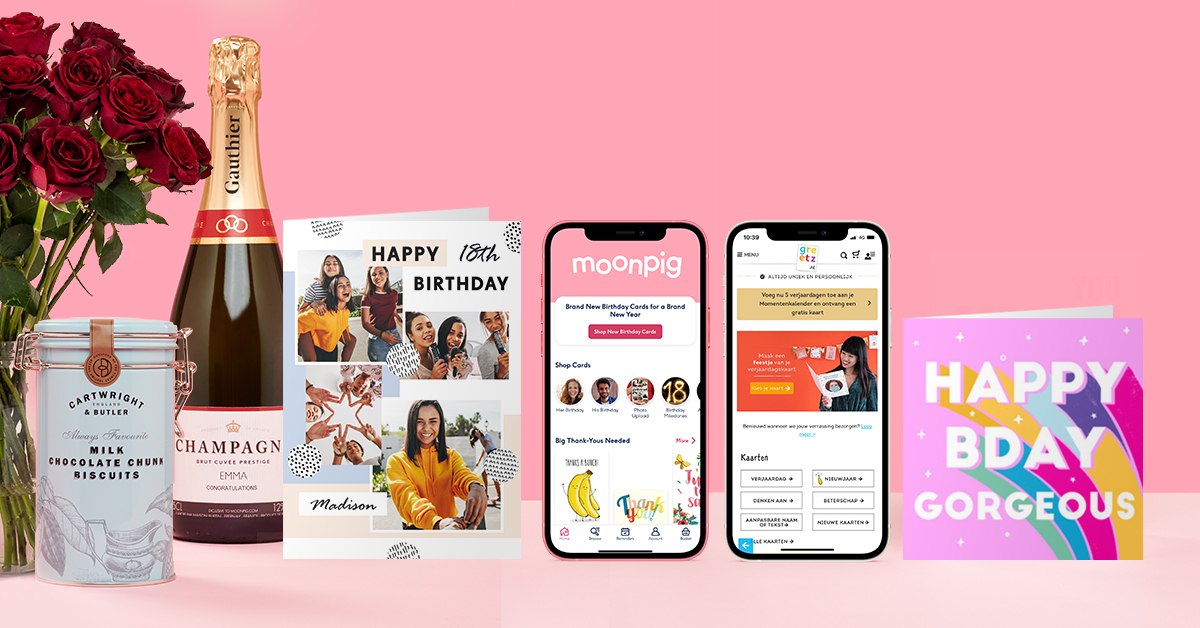

Top: Moonpig Group had 12.2 million active customers as of October 2020.