Online greetings giant still upbeat, claiming 16% of card sales now online

The cost-of-living crisis and Royal Mail strikes have caused Moonpig to cut its revenue forecast for the year from £350million to £320m, but the online greetings giant still posted an upbeat message in its half-year results.

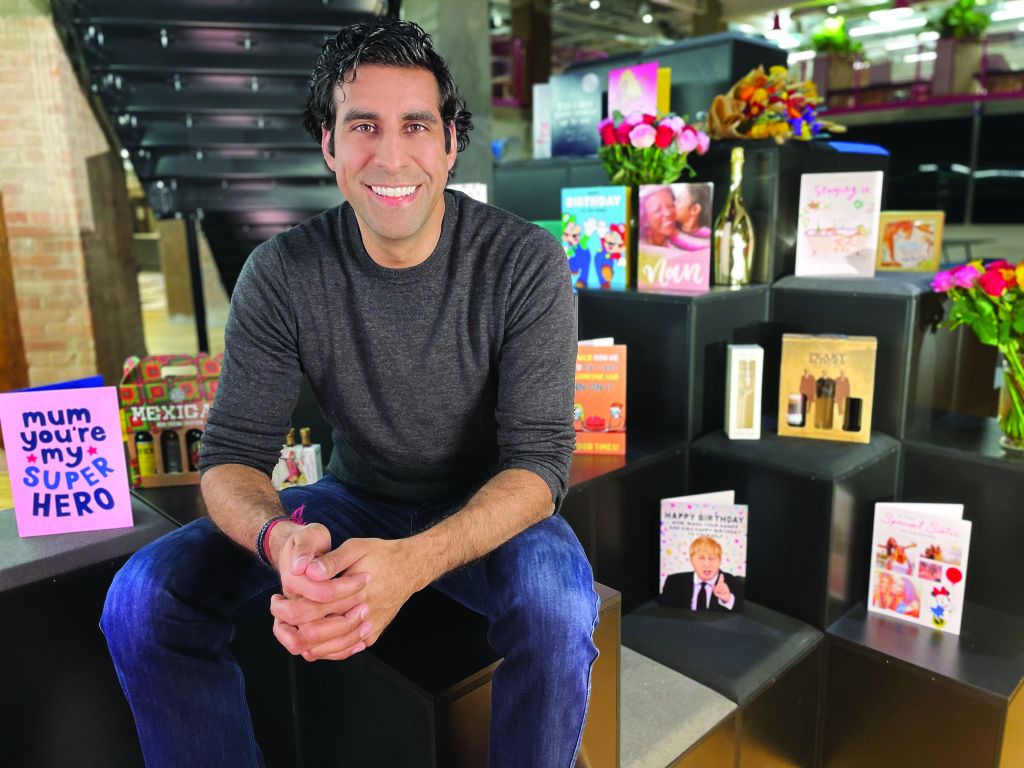

“Despite the difficult trading environment, we have delivered a robust set of results and, with our data-led model, we are ideally positioned to capture the significant long-term opportunities in our markets,” commented Moonpig Group ceo Nickyl Raithatha in a statement on Wednesday, 7 December.

In its half-year results, the FTSE 250 group said revenue for the year would be about £320m because of challenging trading conditions and “the continued macroeconomic uncertainty”.

Trading at Moonpig and its Dutch-based sister card and gift business Greetz reflected the more challenging conditions seen from October onwards and was also impacted in the UK by industrial action at Royal Mail during September and October, which affected last-minute card-only orders on each strike day.

With eight of the ongoing strike days falling in the period covered by Moonpig’s results, and an unflattering comparison to the surge in sales during lockdowns meant revenues, excluding the experience part of the business such as hot-air balloon rides, fell 8% to £131m from £142min the six months to the end of October.

However, Nickyl remained upbeat: “We are a high-margin, cash-generative business with a large opportunity in front of us and a clear market leadership position. Once the external environment stabilises, we absolutely expect to resume our long-term growth trajectory.”

And he insisted the online greeting card business is still at an early stage, adding: “The long-term trend shows that, clearly, the market continues to move online and the numbers are still low – we think it’s about 16% penetration in the UK,” and the results statement said there is significant opportunity to drive card-attached gifting, with fewer than one in five of orders across Moonpig and Greetz currently containing a gift.

Although the number of orders from Moonpig and Greetz dropped by 13% to 16.9m from 19.5m, the company restated its profit target for the full year of between £85m and £88m because of the size of its profit margin. Its strategy to navigate the uncertain economic outlook is focusing on the higher-margin cards business and offering a cheaper range of gifts to customers.

Moonpig’s pre-tax profits halved in the first six months to £9.1m from £18.7m in the same period the previous year, partly driven by increased interest payments on its purchase of Red Letter Days and Buyagift in July as it expanded into the gift and experiences market.

The company said it has “continued focus on innovation”, including testing the Moonpig Plus subscription service ahead of launch, the roll-out of video greeting cards across its design range and ongoing work to build digital gift experiences capability, plus its Moments For Less gift range has been introduced to meet increased consumer demand for gifting at lower price points, and the new in-house facilities at both Tamworth in the UK and Almere in the Netherlands are now fully operational.

And the report said: “We have successfully navigated progressively more challenging trading conditions through October and November, across all segments of the group, and we are operating the business on the basis that this environment will continue in the near term.

“Greeting card revenue and existing customer revenue have both grown year-on-year on an underlying basis after taking into account the prior year impact of Covid on sales. Experiences has performed in line with our expectations at the time of acquisition. However, levels of new customer acquisition have decreased year-on-year and we have seen consumers trading down to lower gifting price points at Moonpig and Greetz. UK card-only orders have also been impacted by industrial action at Royal Mail during September and October.”

Nickyl added: “As the clear online leader in greeting cards, Moonpig Group is positioned to benefit as the market continues the long-term structural shift to online. Our resilient business model offers a powerful and unique combination of leading market positions, strong customer retention, high profitability and robust cash generation, giving us flexibility to manage through the economic cycle. As a result, our expectations for profit for the current financial year remain unchanged.”

Shares in the company fell 13½p in a day following the announcement on 7 December, closing at 137¾p and The Times reported Davy Research analyst David Reynolds as saying: “UK-centric business models are caught in the downdraft of a recession and what that does for consumer sentiment, the rising cost of living and their ability to spend.” He said the share price fall came as investors were spooked by the company’s rapid change to its revenue target, which it restated only in September.

In a note, analysts at Peel Hunt said: “The reasons for the downgrade are out of Moonpig’s hands and one-off in nature.”

Top: Moonpig is confident for Christmas despite postal strikes