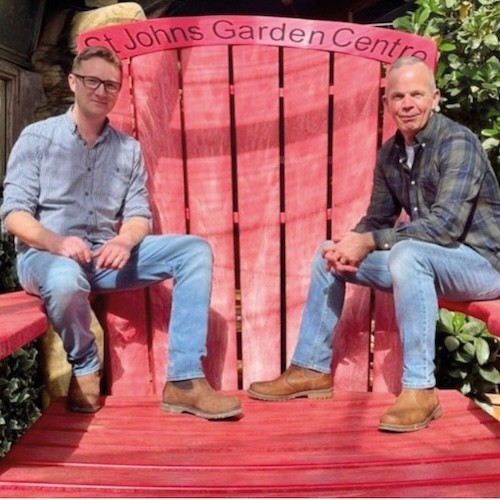

Convenience and card retailer in bid to save 120-year-old business and 16,000 jobs

Convenience chain McColl’s has confirmed it is seeking a capital injection in a bid to stop the 120-year-old business from collapsing, threatening 16,000 retail jobs.

With a string of 1,100 managed convenience stores and newsagents, all selling a wide range of greeting cards among the foodstuffs and essential items, a McColl’s announcement yesterday (Monday, 28 February) said it continues to receive credit support from key commercial partners as it tries to secure a long-term agreement with lending banks.

With 16,000 staff, roughly 6,000 on a full-time equivalent basis, the sheer size of the operation makes McColl’s a large card retailer, and Tim Fairs left his post as Clintons vice-president marketing and e-commerce to become the chain’s customer director for 3½ years to June 2021.

The announcement came in response to media speculation – which includes that a takeover approach for the whole business was received and them withdrawn – and said: “The group confirms it remains in ongoing discussions with its lending banks, as previously announced on 29 November, 2021, towards a longer-term agreement in relation to the balance of the facility. The group has received the necessary agreement to roll forward its financial covenant test periodically, and continues to receive credit support from its key commercial partner to enable these discussions.

“The group continues to believe that a financing solution will be found that involves its existing partners and stakeholders. A further update will be made as and when these discussions conclude.”

Despite raising £30million in September 2021, McColl’s annual revenue had dropped by 11% to £1.1billion in the latest financial year while net debt increased from £89.6m at the end of 2020 to £97m to 28 November 2021.

The statement added: “Since the start of the new financial year, there has been a tangible improvement of product availability in stores, however, the business saw a material step-down in footfall due to the surge in Covid19 cases relating to omicron, particularly over the Christmas period, impacting trading. While demand has since picked up, revenues in the first quarter are behind expectations.

“Despite this, the group delivered two-year like-for-like sales growth of 5.9% in the 11 weeks to 13 February, 2022, in line with the neighbourhood convenience market. The group is starting to experience strengthening margin as impulse product sales recover, and has taken further mitigating actions, including a full review of pricing and costs.”

Of the £30m raised, two-thirds went to accelerate and enhance the Morrisons Daily store rollout planned to hit 450 conversions in total, with 200 already in operation. The balance of the funds was to be used to enhance the group’s working capital headroom, however, the trading shortfall in the second half of FY21 has absorbed this, driven by the product availability challenges experienced.

Top: One of McColl’s 1,100 convenience stores