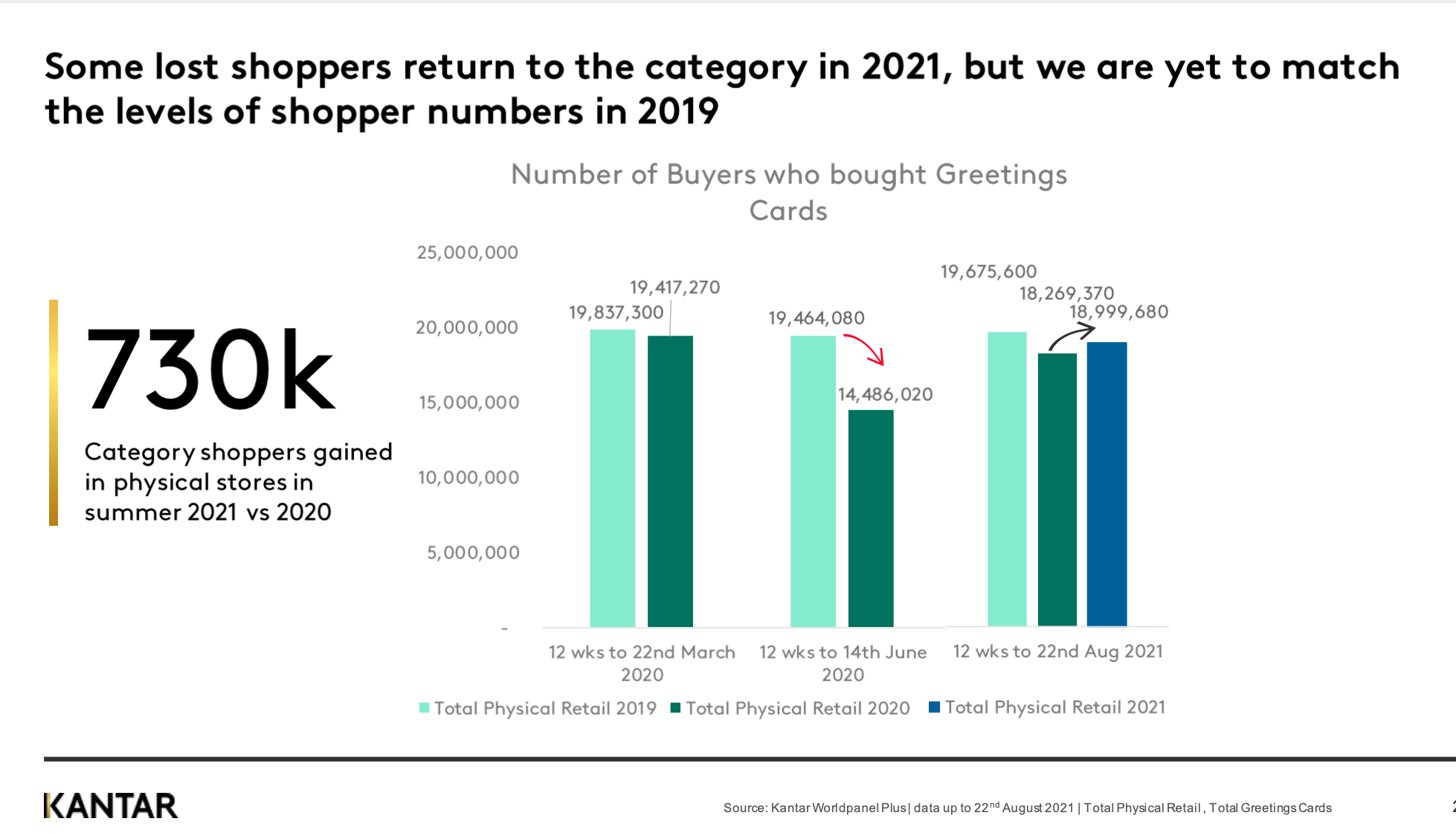

‘It is true that eCommerce won the ‘Covid spend’ but greeting card shoppers are already leaving this channel’ and returning to bricks and mortar retailers. This is one of the insights from the latest research report by Kantar. Another is how supermarkets’ share is showing a dip with the high street rallying a bit.

This has come to light as the major research company has recently started tracking consumer purchasing habits of greeting cards as part of its Worldpanel Plus programme.

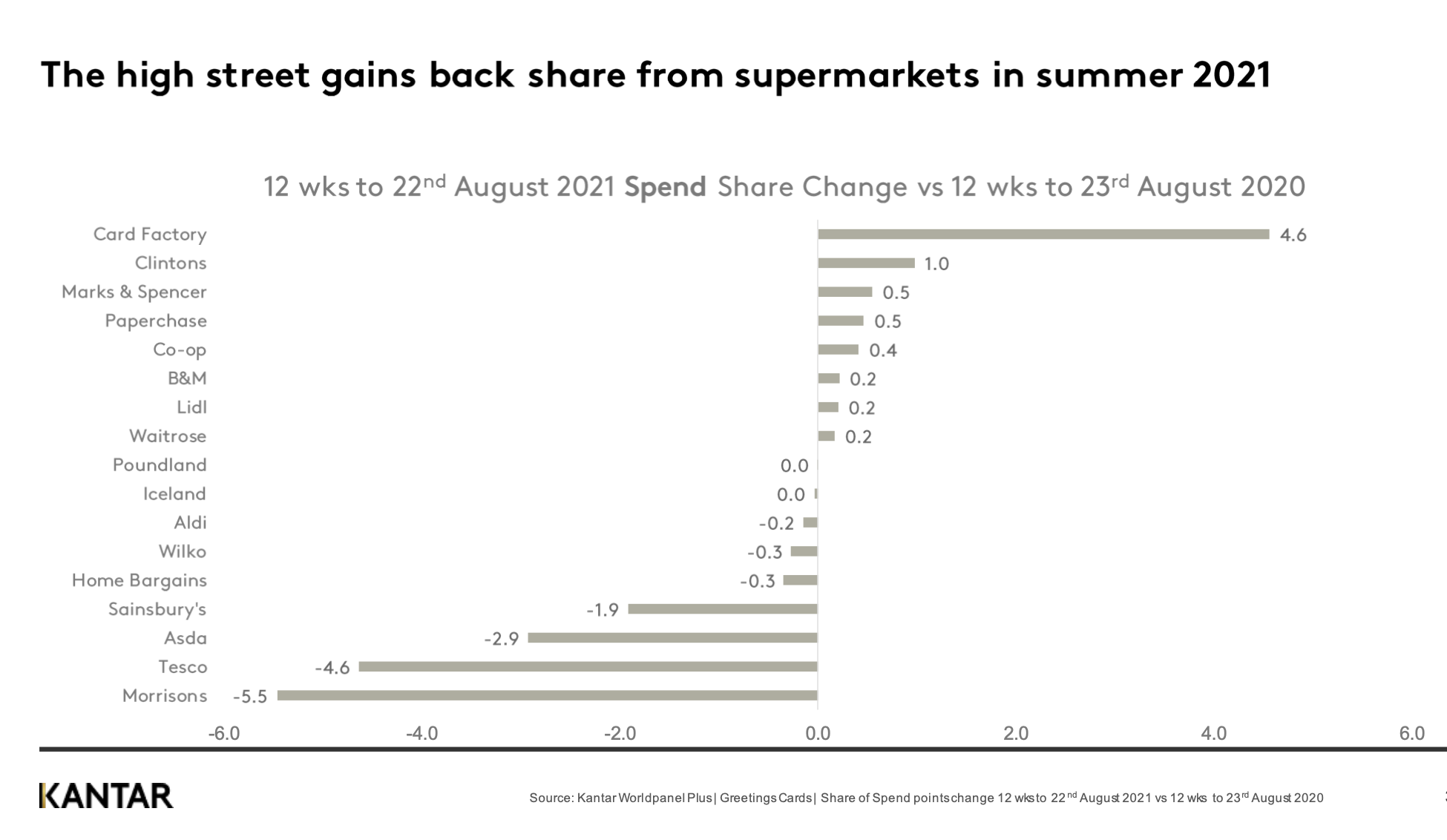

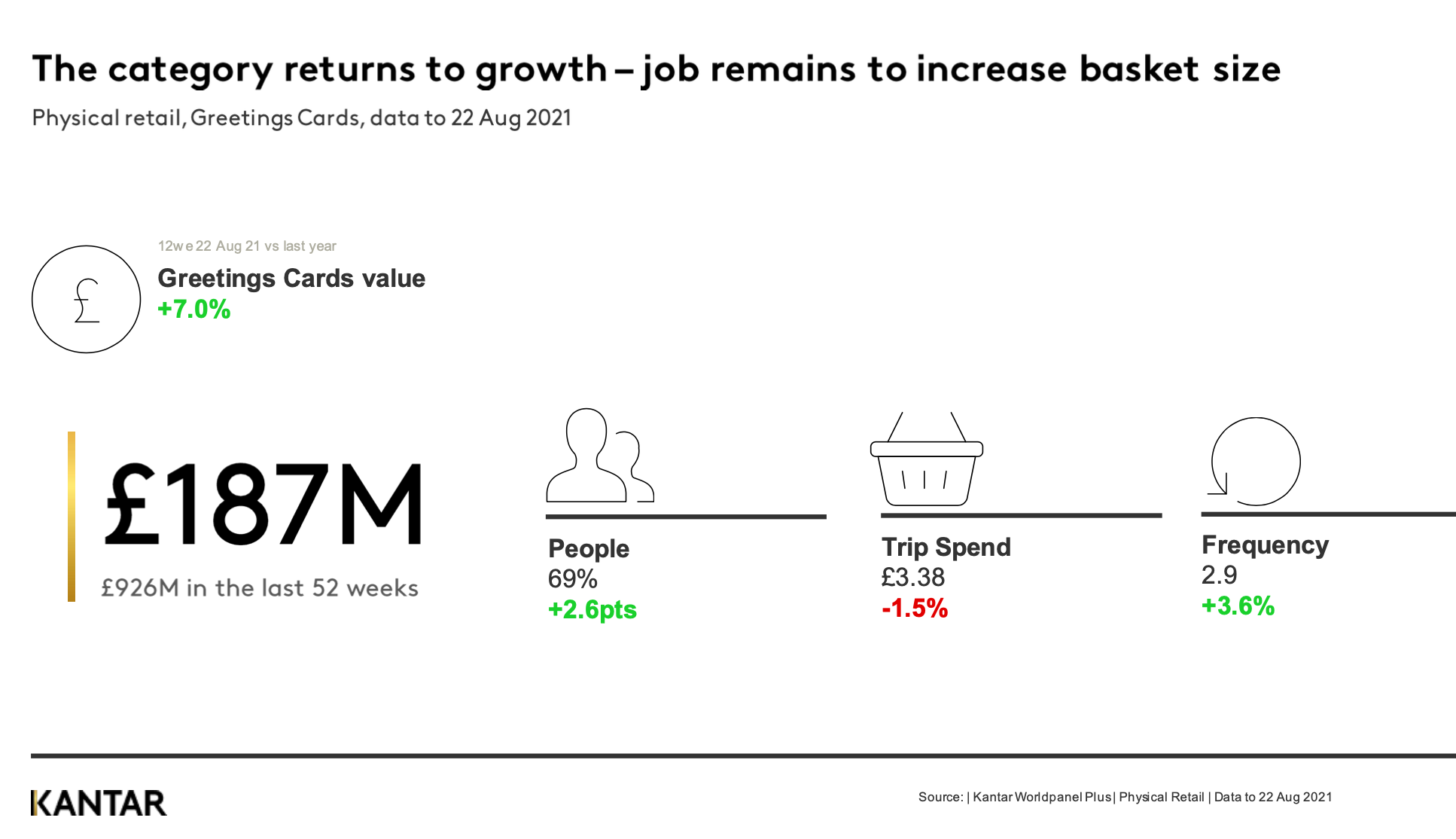

Among the highlights of Kantar’s consumer survey ‘Understanding the UK Greeting Card Industry’ for the 12 weeks to 22 August 2021 (compared with the same period last year), are that high street multiples, notably Card Factory, Clintons, M&S and Paperchase have clawed back market share on the card buying front while some leading supermarkets have dropped back a bit from their high point last year.

Commenting on the findings, as Jo Parman, strategic insights director of the Worldpanel Plus Team at Kantar told PG Buzz: “The pandemic unlocked e-commerce for practically every retail sector and greetings is no different. The pace of change is now slowing down and we’re seeing online purchases start to settle at around 12% of sales.”

She also recognises the important role greeting cards play in human behaviour: “There is a sense of an emotional impetus driving change as people longed for connection to one another last year – the greetings sector offered an important way for people to stay in touch and to show they care from afar. We’re still facing challenging times and it will be interesting to see how that desire to show the special people in our lives how much they mean will convert into sales for the sector.”

As to why Kantar has decided to start tracking greeting card sales, Jo added: “It’s a dynamic time for the greetings sector and that flux creates demand for high-quality data and insight. That’s what we can offer to retailers and publishers, helping them to understand, respond to and anticipate trends.”

Top: The lure of physical shopping is winning back customer pennies on the greeting card front.